Blueacorn Pppromm Washingtonpost

The article titled ‘blueacorn pppromm washingtonpost’ aims to provide objective and informative insights into the Blueacorn Pppromm Washingtonpost, with a specific focus on its coverage by The Washington Post.

This article will explore the program’s efforts to simplify the PPP loan forgiveness application process, help readers understand its requirements and documentation, and ultimately assist them in maximizing their loan forgiveness.

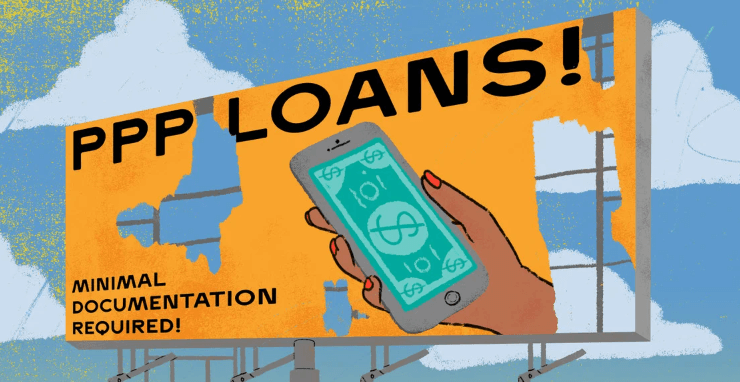

In recent times, many businesses have faced significant challenges due to the economic impact of the COVID-19 pandemic. As a result, government support programs like the Paycheck Protection Program (PPP) have been essential in providing financial relief. However, navigating the complexities of these programs can be daunting for business owners who are already burdened with numerous responsibilities.

Therefore, understanding how initiatives such as blueacorn pppromm aim to streamline processes and ensure that eligible businesses receive the maximum possible loan forgiveness is crucial for those seeking assistance.

By examining The Washington Post’s coverage of blueacorn pppromm, this article seeks to present an unbiased analysis of how this program addresses key concerns regarding PPP loan forgiveness. It will discuss various aspects such as simplified application procedures and necessary documentations that can help business owners fulfill requirements effectively. Additionally, it will highlight strategies that entrepreneurs can adopt to maximize their chances of obtaining full or partial loan forgiveness.

Presented in an engaging style suitable for an audience yearning for freedom from financial stressors, this article aims to provide valuable information while addressing readers’ subconscious desire for accessible pathways towards economic recovery.

Simplify the PPP Loan Forgiveness Application Process

The simplification of the PPP loan forgiveness application process aims to streamline and expedite the bureaucratic procedures, reducing administrative burden on small business owners and fostering a sense of relief and optimism among entrepreneurs who have been grappling with the economic fallout of the pandemic.

By streamlining the application, it becomes easier for small business owners to navigate through the complex requirements and submit their applications in a timely manner. This reduces paperwork and eliminates unnecessary documentation, saving time and effort for both business owners and lenders.

The simplified process also provides clarity on what information is required, ensuring that applicants can provide accurate and complete information without confusion or ambiguity.

Ultimately, this efficient approach not only facilitates faster loan forgiveness decisions but also instills a sense of confidence among small business owners that they can overcome financial challenges more easily.

Read Also Microsoft Brad Smithmurphybloomberg

Understand the Requirements and Documentation

Understand the Requirements and Documentation necessitates a comprehensive examination of the specified criteria and accompanying paperwork.

To successfully navigate the loan forgiveness application process, it is essential to have a thorough understanding of the requirements that must be met and the documentation that needs to be provided. This involves carefully reviewing the guidelines provided by the Small Business Administration (SBA) and ensuring that all necessary information is accurately documented.

The requirements for PPP loan forgiveness may include maintaining employee headcount, using funds for eligible expenses such as payroll costs, rent, utilities, and mortgage interest, and spending a certain percentage of the loan amount on payroll costs.

Additionally, documentation such as payroll reports, bank statements, tax forms, lease agreements, utility bills, and receipts may need to be submitted to support the forgiveness application.

By comprehending these requirements and effectively organizing the required documentation, borrowers can increase their chances of obtaining loan forgiveness while adhering to SBA guidelines.

Maximize Your Loan Forgiveness

To maximize your loan forgiveness, a strategic approach is required to effectively manage eligible expenses and meet the specified criteria set by the Small Business Administration (SBA). Here are four strategies for optimizing loan forgiveness:

- Document all eligible expenses: Keep meticulous records of payroll costs, rent or mortgage payments, utilities, and other eligible business expenses. This documentation will help support your forgiveness application.

- Maintain employee headcount and salary levels: To qualify for full loan forgiveness, it is crucial to maintain the average number of full-time equivalent employees during the covered period. Additionally, avoid reducing salaries by more than 25% for any employee earning less than $100,000 annually.

- Use funds appropriately within the covered period: Spend at least 60% of PPP funds on payroll costs to ensure maximum loan forgiveness. The remaining 40% can be used for eligible non-payroll expenses such as rent or mortgage interest, utilities, and certain operational costs.

- Apply for forgiveness in a timely manner: Submit your forgiveness application promptly after utilizing all PPP funds or when you have met all requirements outlined by the SBA.

While striving to maximize loan forgiveness is important, it is equally crucial to avoid common mistakes that could jeopardize your eligibility:

- Misclassifying expenses: Ensure that only qualifying expenditures are included in your loan forgiveness application. Non-eligible expenses such as bonuses or payments to independent contractors should not be included.

- Failing to maintain proper documentation: Accurate record-keeping is essential throughout the entire process. Make sure you have supporting documents readily available to substantiate every expense claimed in your application.

- Neglecting employment-related requirements: Remember that maintaining employee headcount and salary levels are critical factors in securing full loan forgiveness.

- Disregarding program updates and guidance from SBA: Stay informed about any updates released by the SBA regarding PPP guidelines and ensure compliance with new rules or changes that may impact your loan forgiveness eligibility.

By following these strategies and avoiding common mistakes, you can maximize the chances of receiving full loan forgiveness while navigating through the PPP program.

Read Also Meta Identifiers Identifiersburriescimeta

Conclusion

The process of applying for Blueacorn Pppromm Washingtonpost can be simplified by following a few key steps.

First, it is important to thoroughly understand the requirements and documentation needed to support your application. This includes providing accurate information about your payroll costs, non-payroll costs, and any employee headcount reductions.

By carefully reviewing the guidelines provided by the Small Business Administration (SBA), you can ensure that you are submitting all the necessary documents and calculations. This will help maximize your chances of receiving full loan forgiveness.

Additionally, keeping detailed records of how you used the loan funds can strengthen your case for forgiveness.

In conclusion, navigating the PPP loan forgiveness application process requires careful attention to detail and adherence to SBA guidelines. By understanding the requirements and providing accurate documentation, you can increase your chances of having your loan fully forgiven. Remember to keep thorough records of how you used the funds, as this will help support your application. As small businesses continue to face challenges during these uncertain times, simplifying and maximizing loan forgiveness is crucial for their survival and recovery.