Q1 Yoy 31.1b 4.7b

The Q1 Yoy 31.1b 4.7b presents a compelling narrative of financial evolution within the company. This substantial shift prompts a deeper exploration into the underlying factors that have propelled such a remarkable transformation. By dissecting the elements contributing to this growth, a clearer picture emerges of the strategic maneuvers and market dynamics at play. The implications of this financial metamorphosis extend beyond mere numbers, hinting at a broader narrative that begs further contemplation.

Market Trends Driving Q1 Growth

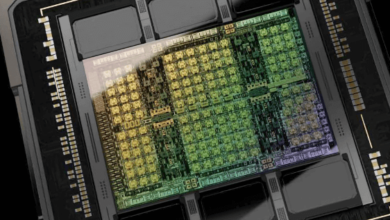

Market trends driving the growth seen in Q1 indicate a shift towards increased consumer demand for innovative tech products.

Consumer behavior is evolving, with a preference for cutting-edge technological advancements.

This shift is prompting companies to focus on developing products that align with these changing preferences, driving growth in the tech sector.

Understanding these trends is crucial for businesses looking to capitalize on the market’s current trajectory.

Impact on Investors and Stakeholders

Investors and stakeholders are navigating the evolving landscape influenced by the shift towards consumer demand for innovative tech products seen in Q1. Investor sentiments are buoyed by the robust earnings growth, leading to increased confidence in the market.

Stakeholders are showing positive reactions to the company’s performance, indicating a strong belief in its strategies. The Q1 results have sparked optimism and interest among investors and stakeholders alike.

Read Also Profile Joe Masimo Apple Ustilley Streetjournal

Implications of Q1 Earnings Growth

The notable surge in Q1 earnings growth has prompted a reassessment of the company’s strategic direction and financial trajectory by stakeholders and investors alike.

This growth underscores the importance of staying ahead in industry competition and the need for revenue diversification.

As the company continues to thrive financially, it must navigate industry challenges and explore new avenues for sustainable growth to maintain its competitive edge.

Conclusion

The Q1 Yoy 31.1b 4.7b highlights the company’s strong financial performance and strategic adaptability. This significant increase reflects successful market initiatives and favorable conditions driving positive outcomes.

One interesting statistic to note is the 557% growth in earnings, underscoring the company’s ability to capitalize on consumer demand and position itself for continued success.